News

High Tide Resources Announces Maiden Mineral Resource Estimate at its Labrador West Iron Project

February 23, 2023

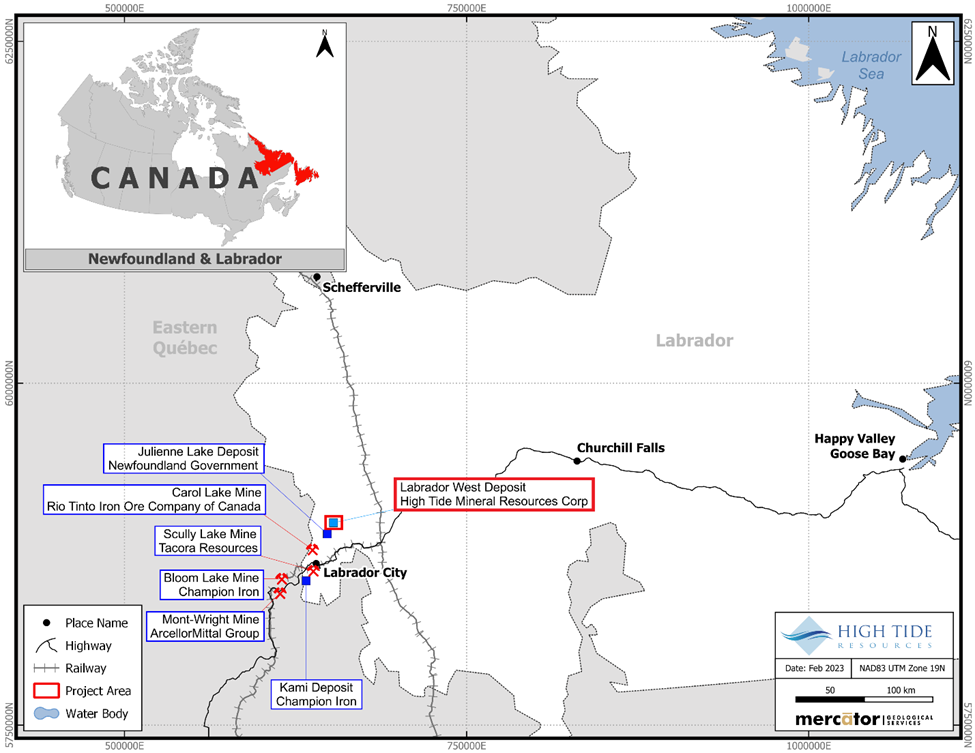

TORONTO, February 23, 2023 – High Tide Resources Corp. (“High Tide” or the “Company”) (CSE: HTRC) is pleased to announce the release of its maiden Mineral Resource Estimate (“MRE”) for its flagship Labrador West Iron Project (the “Project” or “Property”). The Property is located in the southern Labrador Trough, home to four operating iron ore mines, and less than 20 km northeast of IOC/Rio Tinto’s Carol Lake Mine complex in Labrador City, Newfoundland and Labrador (Figure 1).

Steve Roebuck, Director, President & Interim CEO of High Tide states, “This is a major milestone for the Company and we are extremely pleased with the results of the maiden Mineral Resource Estimate. The deposit is robust, starts at surface and has great potential to grow in size. We have a very strong project that should prove appealing to both strategic partners and investors alike. The southern Labrador Trough produces some of the cleanest iron concentrates and pellets in the world, and with demand increasing, and industry pivoting to green iron and green steel, High Tide is very well positioned to be a leader in the next generation of high-quality low-carbon iron projects globally.”

The path forward for the Project will focus on increasing knowledge and confidence levels while reducing risk. Additional infill and step-out drilling will target expansion of the resource in size and its upgrading from the current Inferred category to Indicated and Measured categories, while providing more critical geological information required for further deposit modelling and detailed metallurgical studies. The results of metallurgical testing completed so far indicate a quality concentrate product can be achieved using gravity separation techniques, with results that are comparable to similar iron mining projects in the region.

The Inferred Mineral Resource Estimate was prepared by Mercator Geological Services Limited (‘Mercator’) in accordance with National Instrument 43-101 (NI 43-101), the CIM Standards (May 10, 2014) and CIM MRMR Best Practice Guidelines (November, 2019).

Table 1: Labrador West Mineral Resource Estimate - Effective Date: January 31, 2023

|

Type |

Cut-off (FeT %) |

Category |

Tonnes (millions) |

(FeT %) |

|

Pit Shell Constrained |

15 |

Inferred |

654.9 |

28.84 |

Notes:

- Total iron (FeT) Mineral Resources include only oxide-facies iron formation (magnetite or hematite dominated).

- Mineral Resources are defined within an optimized conceptual pit shell with an overall pit slope angle of 50⁰ and a 1.3:1 strip ratio (waste: mineralized material)

- Pit shell optimization parameters include: pricing of CDN $129 /tonne for 65% Fe concentrate, exchange rate of CDN$1.30 to US$ 1.00, mining cost at CDN $3.00/t, processing cost at CDN $4.55/t processed, tailings cost at CDN $0.35 processed, rail & port cost at CDN $18.00/t shipped, G & A Cost at CDN $5.00/t processed, Ocean Freight at $28.00/t shipped and mill recovery at 80%. Mineral Resources

- A cut-off grade of 15% FeT was selected for definition of the Mineral Resource.

- Mineral Resources were estimated using Inverse Distance Squared methods applied to 3 m downhole assay composites. Iron grades were capped at 50 % FeT. Model block size is 20 m (x) by 20 m (y) by 12 m (z).

- Bulk density for the block model was calculated from a linear regression relationship between FeT (%) and specific gravity measurements from the Labrador West project. The average bulk density estimated for the deposit is 3.10 g/cm3

- Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resource tonnages are rounded to the nearest 100,000.

Please join us for an aftermarket Zoom call today at 4:15 PM (EST) to discuss the news with Director & Interim CEO Steve Roebuck.

https://us06web.zoom.us/j/81660730868?pwd=VEdIdlptQisvdXl2UlFKNW5teTBWZz09

High Tide will be attending PDAC in Toronto from March 5 to 8 in Booth 3016 and participating in the PDAC one to one meeting program – please request a High Tide meeting or drop by the booth if you would like to learn more about the Project.

A Technical Report prepared in accordance with NI 43-101 Form F-1 supporting the MRE reported herein for the Labrador West Project will be filed on SEDAR (www.sedar.com) within 45 days and announced by news release.

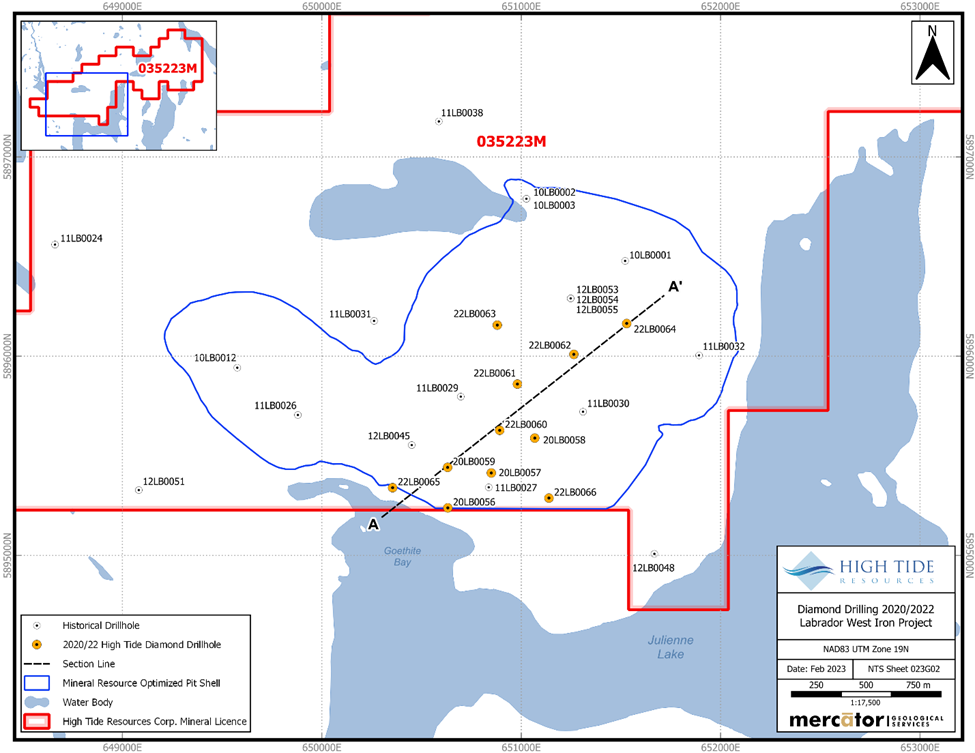

Labrador West Iron Project

The Labrador West Iron Project is comprised of one mineral licence (99 mineral claims), 2,475 hectares in size. The area was explored and drilled by Rio Tinto Exploration from 2010 to 2012, and then by High Tide Resources in 2020 & 2022. To date, approximately 7,500 m of core in 27 completed holes has been drilled on the property. Located less than 20 kilometres northeast of Labrador City, the Project is proximal to all the critical infrastructure required to explore and develop a major new iron deposit in the heart of the southern Labrador Trough. Experience by major producers operating in the Labrador Trough indicates that hematite and magnetite in this geological setting are readily recoverable using modern, industry standard beneficiation methods, that produce high purity, desirable iron concentrates.

Iron and the Western Labrador Trough Infrastructure Advantage

The Labrador Trough of western Labrador and adjoining Quebec constitutes Canada’s primary iron producing district and is host to world-class deposits that have been mined for more than half a century. These have produced over 2 billion tonnes of iron ore to date and are considered to have very significant growth potential. The high quality of the deposits in the region allows for a wide range in product diversity, which includes premium fines, concentrate and pellet grades.

The Property is strategically located near the mining communities of Wabush and Labrador City in the province of Newfoundland & Labrador and Fermont in Quebec. The area is home to Champion Iron Ore’s Bloom Lake Mine, Arcelor Mittal’s Mont-Wright Mine, Tacora Resources’ Scully Mine, and Rio Tinto IOC’s Carol Lake Mine.

The Wabush and Labrador City region is very well served with skilled labour and a highway as well as access to abundant low-cost hydroelectricity and a common carrier railway. The railway has 80 million tonnes per year of capacity for transport of iron products to the deep-water port of Sept Isles, Quebec, which provides year-round access to global markets.

About High Tide

High Tide is focused on and committed to the development of mineral projects critical to infrastructure development using industry best practices combined with a strong social license from local communities. High Tide owns a 100% interest in the Labrador West Iron Project located adjacent to the Carol Lake Mine in Labrador City, NL and owns a 100% interest in the Lac Pegma copper-nickel-cobalt deposit located 50 kilometres southeast of Fermont, Quebec and is earning a 100% interest in the road accessible Clearcut Lithium Project located ~75 kilometres southwest of Val d’Or, Quebec and the Big Bang Lithium Project located ~275 kilometres northeast of Thunder Bay, Ontario. Majority shareholder Avidian Gold (TSX.V: AVG) controls approximately 28% of High Tide’s outstanding shares.

Further details on the Company, including a property Technical Report on the Labrador West Iron Project can be found on the Company’s website at www.hightideresources.com .

Qualified Person Statement

All scientific and technical information disclosed in this news release was reviewed and approved by Steve Roebuck, P.Geo., President & VP Exploration of High Tide Resources Corp. and a Qualified Person as defined under NI 43-101. The Mineral Resource Estimate disclosed in this news release was prepared by Ryan Kressall, P. Geo., and Matthew Harrington, P. Geo., of Mercator, each a Qualified Person as defined under NI 43-101.

For further information, please contact:

Steve Roebuck

Director, President & Interim CEO

Mobile: +1 (905) 741-5458

Email: moc.secruoseredithgih@kcubeors

Neither Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Sampling Protocol, Analytical Procedures and QAQC

Mercator supervised the 2020 and 2022 diamond drilling programs carried out by High Tide that contribute to support of the current Mineral Resource Estimate. This included designing and implementing a comprehensive QAQC program consistent with CIM best practice methods. Core was delivered to a secured location for geological and geotechnical logging, and sampling. After core logging, core was marked for sampling and splitting. Certified reference materials were used for blanks and standards and inserted at a rate of every alternating 10th sample. Quarter core duplicates were also collected every 40th sample and laboratory duplicates (alternating between coarse reject and pulp splits) were also analyzed every 40th sample. All split samples were stored in a secure location in sealed shipping bags prior to shipment to the laboratory for assay testing.

Sample shipments were securely delivered via courier to Activision Laboratories (“ActLabs”) in Ancaster, Ontario for sample preparation and analytical testing. Sample preparation was through the laboratory’s standard rock preparation protocol that begins with jaw crushing followed by pulverization of a sample split (250g) to generate a pulp having 95% passing 0.105 mm grain size. Iron (Fe) content was measured using the Lithium Metaborate fusion technique. Prior to fusion, the loss on ignition (LOI), which includes H2O+, CO2, S and other volatiles, is determined from the weight loss after roasting the sample. The fusion disk is made by mixing the roasted sample with a combination of lithium metaborate and lithium tetraborate. Samples are fused in Pt crucibles using an automated crucible fluxer and automatically poured into Pt molds for casting. Samples are then analyzed on a Panalytical Axios Advanced wavelength dispersive XRF. Actlabs is an accredited analytical services firm that is ISO 17025 registered. Actlabs is fully independent of both High Tide Resources and Mercator.

Mercator also reviewed the QAQC protocols and results associated with the 2010-2012 Rio Tinto diamond drilling campaigns and found the procedures and results satisfactory.

Forward looking information

This news release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, closing of the Agreement, exercising the Option, the acquisition of low cost and potentially high reward lithium projects, the ability to keep exploration costs low, expected access to regional lithium processing hubs, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: the ability to anticipate and counteract the effects of COVID-19 pandemic on the business of the Company, including without limitation the effects of COVID-19 on the capital markets, commodity prices supply chain disruptions, restrictions on labour and workplace attendance and local and international travel, failure to receive requisite approvals in respect of the foregoing, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Figure 1: Labrador West Property Location Map

Figure 2: Labrador West Deposit – Mineral Resource Optimised Pit Shell with DDH’s and A to A’ Line Location - Planview

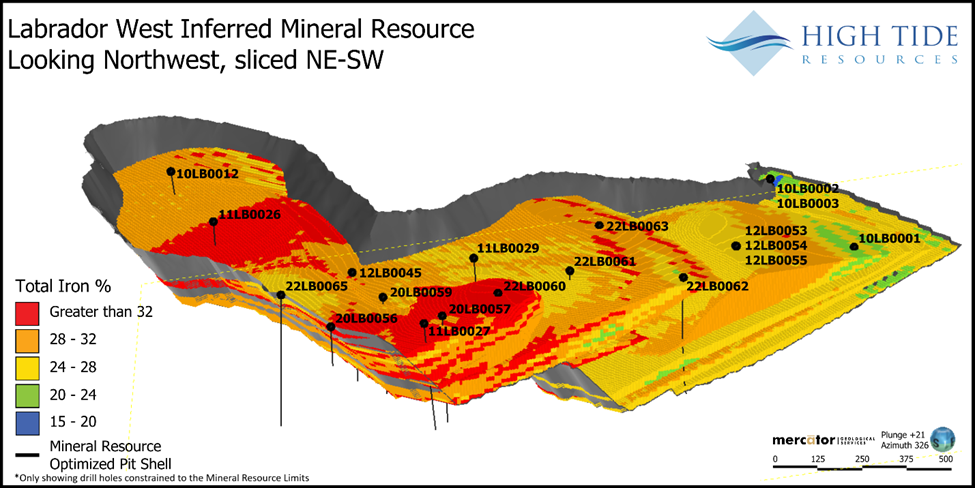

Figure 3: Labrador West Deposit – Block Model Showing Grade, Drilling and Pit-Constrained Resource Outline

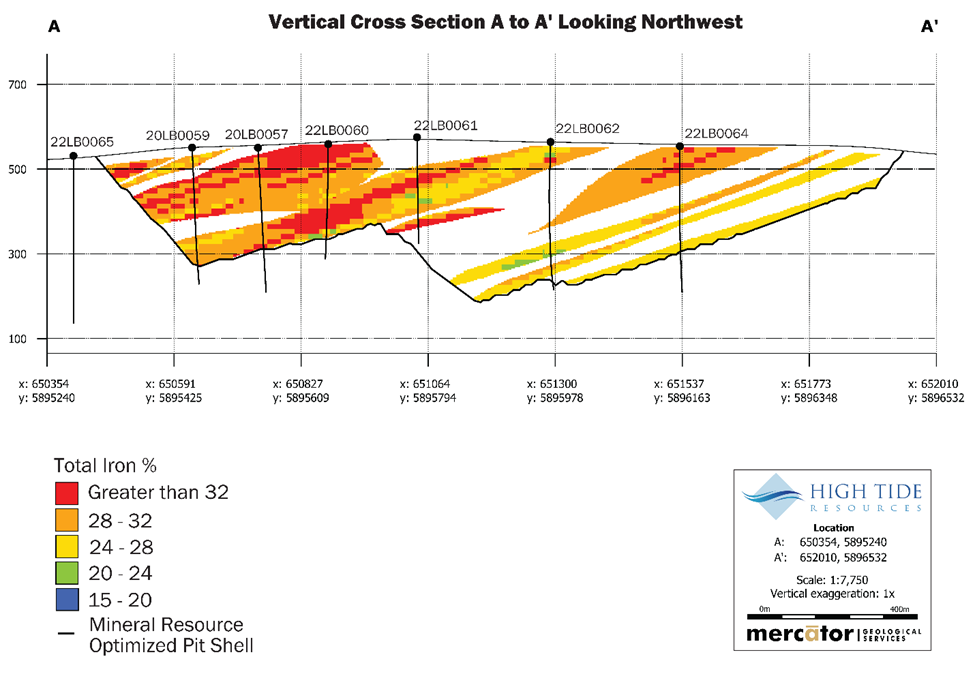

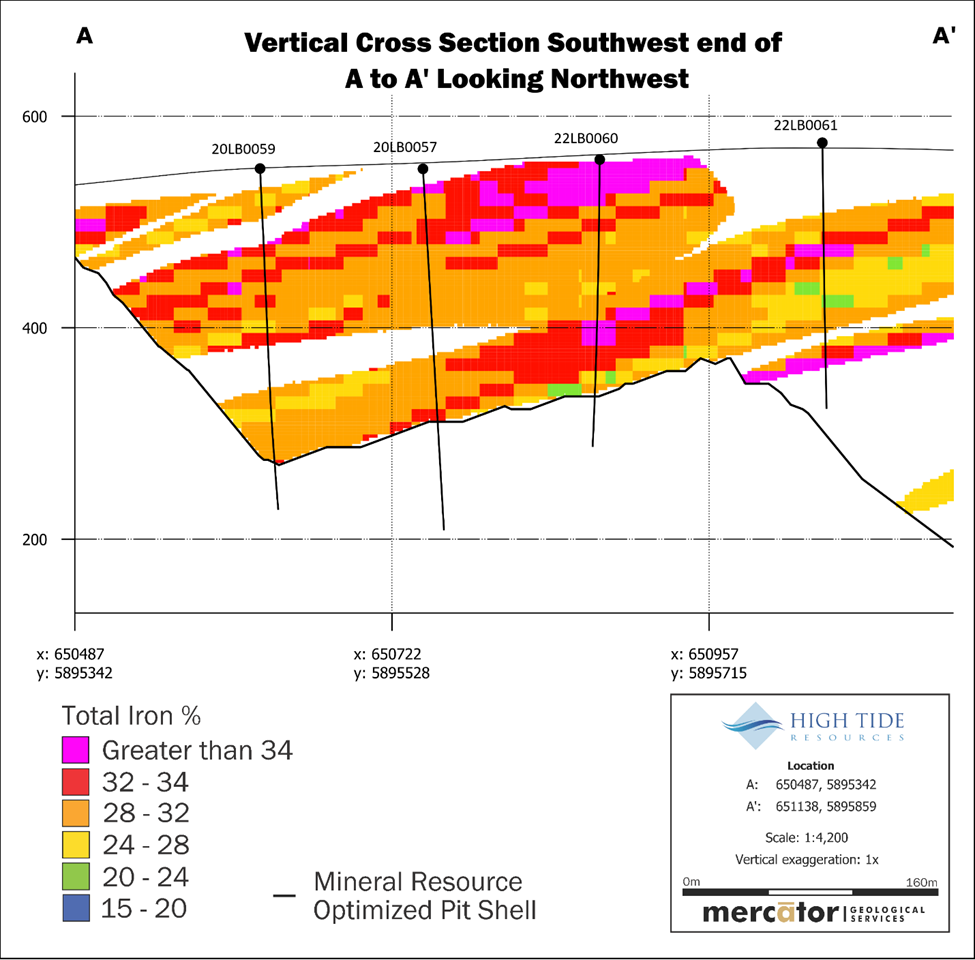

Figure 4: Labrador West Deposit - Section View Along A to A’ Looking Northwest

Figure 5: Labrador West Deposit – Close-Up High-Grade Iron - Section View Along A to A’

Topic: Steve Roebuck's Zoom Meeting

Time: Feb 23, 2023 04:15 PM Eastern Time (US and Canada)

Join Zoom Meeting

https://us06web.zoom.us/j/81660730868?pwd=VEdIdlptQisvdXl2UlFKNW5teTBWZz09

Meeting ID: 816 6073 0868

Passcode: 207335

One tap mobile

+12532050468,,81660730868#,,,,*207335# US

+12532158782,,81660730868#,,,,*207335# US (Tacoma)

Dial by your location

+1 253 205 0468 US

+1 253 215 8782 US (Tacoma)

+1 301 715 8592 US (Washington DC)

+1 305 224 1968 US

+1 309 205 3325 US

+1 312 626 6799 US (Chicago)

+1 346 248 7799 US (Houston)

+1 360 209 5623 US

+1 386 347 5053 US

+1 507 473 4847 US

+1 564 217 2000 US

+1 646 931 3860 US

+1 669 444 9171 US

+1 669 900 6833 US (San Jose)

+1 689 278 1000 US

+1 719 359 4580 US

+1 929 436 2866 US (New York)

Meeting ID: 816 6073 0868

Passcode: 207335

Find your local number: https://us06web.zoom.us/u/k9JvYknoM