News

Avidian's Subsidiary High Tide Resources to Acquire 100% of the Goethite Bay Iron Ore Project from Altius Resources Inc.

August 28, 2019

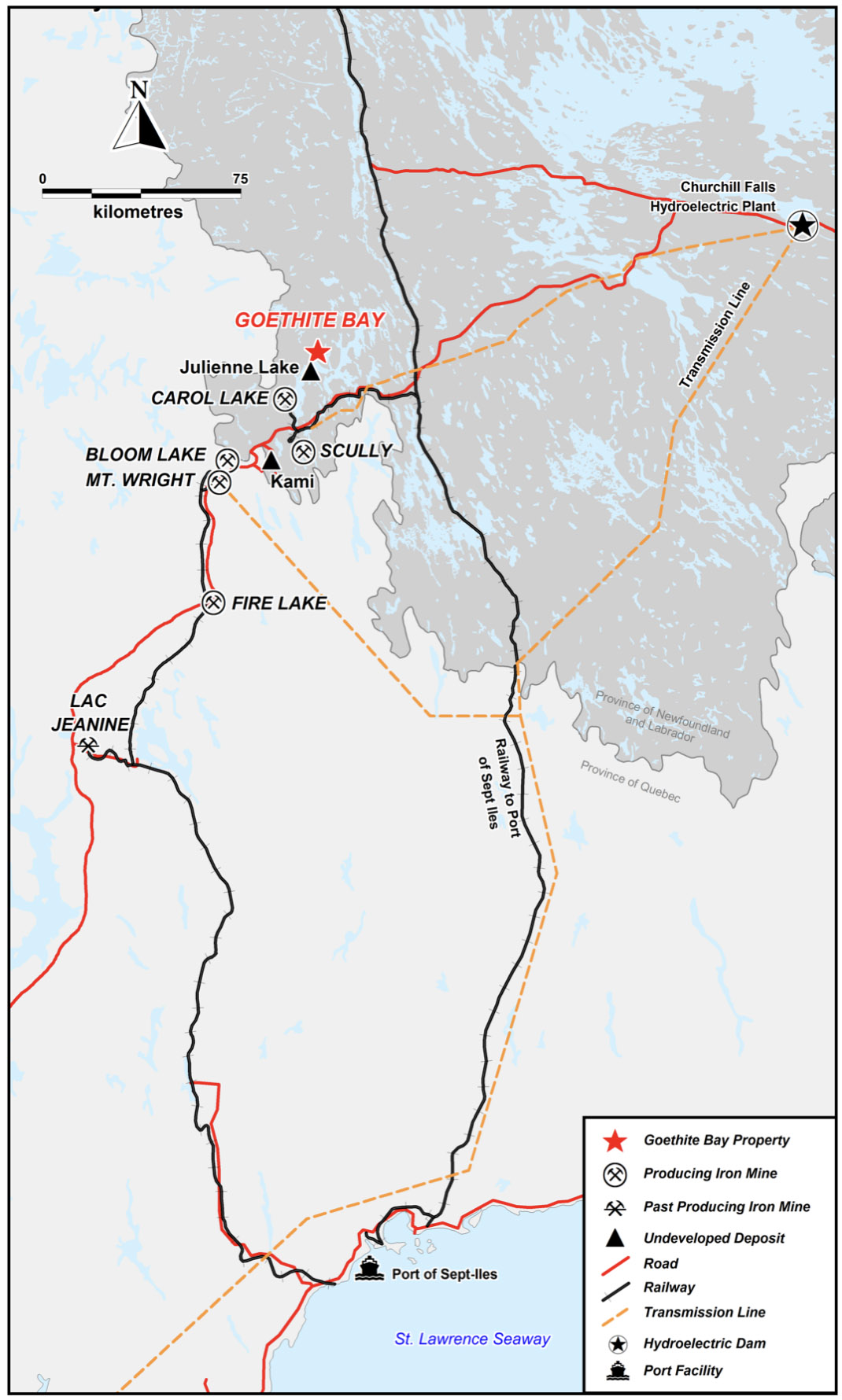

TORONTO, Ontario, August 28, 2019 – Avidian Gold Corp. (“Avidian” or the “Company”) (TSX-V:AVG) is pleased to announce that High Tide Resources Corp. (“High Tide”), a 73% owned private subsidiary, has agreed to terms with Altius Resources Inc. (“Altius”), a wholly owned subsidiary of Altius Minerals Corporation (TSX:ALS), to acquire 100% of the Goethite Bay Iron Ore Project located 17 kilometres northeast of Iron Ore Company of Canada’s (IOC) 23 million tonne per year Carol Lake operation and 6 kilometres north of the Julienne Lake deposit near Labrador City, Newfoundland. Please note the mineralization hosted on IOC’s Carol Lake operation is not necessarily reflective of mineralization that may be hosted on the Company’s Goethite Bay Iron Ore Project.

The 700-hectare Goethite Bay Iron Ore Project (“Goethite Bay” or the “Project”) formed a portion of a broader iron ore exploration joint venture between Rio Tinto Exploration and Altius that ran from 2008 to 2019. The Project has been subject to advanced exploration techniques including airborne and ground geophysics and diamond drilling.

Eighteen NQ diameter holes totaling 4,227 metres were drilled by Rio Tinto at Goethite Bay during 2010, 2011 and 2012. Significant iron mineralization was intersected in multiple drill holes including hole 11LB0027, which yielded 279 metres at 29.8% Fe, including 157 metres at 31.9% Fe and 90 metres at 31.9% Fe. Other significant intercepts are reported in the table below. To date widespread drilling has intersected iron mineralization over an area of 1,800 metres by 2,500 metres to a vertical depth of 420 metres and is still open at depth and along strike. Preliminary metallurgy done by Rio Tinto suggests that the Project has the potential to produce a high-quality, low-impurity iron concentrate at reasonable grind sizes.

Previous Rio Tinto Drilling Highlights Include:

| HOLE ID | Total Depth (m) | Azimuth | Dip | From (m) | To (m) | Interval (m) | Fe % |

|---|---|---|---|---|---|---|---|

| 11LB0026 | 255 | 350 | -80 | 25.5 | 118 | 92.5 | 29.6 |

| And | 185.1 | 223.65 | 38.6 | 29.7 | |||

| 11LB0027 | 348 | 360 | -80 | 56.27 | 336 | 279.73 | 29.8 |

| including | 56.27 | 213.58 | 157.31 | 31.9 | |||

| And | 246 | 336 | 90 | 31.9 | |||

| 11LB0029 | 306.25 | 355 | -80 | 114 | 234 | 120 | 29.4 |

| including | 114 | 167 | 53 | 30.6 | |||

| 11LB0030 | 255 | 6 | -80 | 16.5 | 231 | 214.5 | 26.4 |

| including | 16.5 | 39 | 22.5 | 33.2 | |||

| And | 61.6 | 108 | 46.4 | 28.2 | |||

| 11LB0031 | 207 | 5 | -80 | 25.5 | 125.92 | 100.42 | 28.1 |

| including | 72 | 123 | 51 | 30.3 | |||

| 11LB0032 | 446 | 357 | -80 | 77 | 124 | 47 | 28.4 |

See Altius press release dated March 27, 2012 titled “Altius Provides Update on Selected Iron Ore Projects in Labrador West” (http://altiusminerals.com/press-releases/view/254). True width is unknown at this time. These results are historic in nature and have not been independently verified by High Tide or Avidian.

For more information on the Goethite Bay Project please see the presentation link. http://avidiangold.com/wp-content/uploads/2019/08/HTR-Aug-28-1.pdf

Avidian CEO David Anderson states;

“While acquiring the Goethite Bay Project is not our typical investment, the ability to acquire 100% of a high-quality iron ore project in a robust iron ore market makes sense for our subsidiary, High Tide Resources. The project is a corner stone asset with great upside potential and it is our belief that the investment of a reasonable amount of capital will greatly enhance shareholder value.

Goethite Bay has already seen substantial work completed by Rio Tinto. The historical data base significantly de-risks the project and provides High Tide Resources the information required to commence planning in 2019 for a drill program early next winter. We plan to quickly advance the project, create a maiden resource in 2020 and daylight a significant new iron ore project in the heart of an established mining camp with all its infrastructure advantages.

We are thrilled to be working with the Altius team. Altius is a top-notch company with a track record of success and an in-depth knowledge of the Southern Labrador Trough, the project and iron ore in general. Their support will help greatly in the delineation and ultimately with continued success the development of the Goethite Bay Project.”

Iron Ore and the Western Labrador Trough Infrastructure Advantage

The Labrador Trough of western Labrador and adjoining Quebec defines Canada’s premier iron ore district and is host to world-class deposits that have been mined for half a century producing over 2 billion tonnes of iron ore with significant growth potential. The high quality of the deposits in the region allows for a wide range in product diversity, which includes lump, premium fines, concentrate and pellet grades.

The premiums for +65% Fe concentrate and pellets continues to be supported by the environmental policies of the Chinese governments, which, as in 2017, caused Chinese steel producers to favour the usage of higher value-in-use iron ore. The sustained global demand for high-quality iron ore products, coupled with infrastructure failures at existing Vale operations, has seen the benchmark Fe 62% iron ore price rise from US$65 per tonne to over US$120 per tonne during the past year creating an opportunity for forward-thinking juniors like High Tide Resources with Goethite Bay. Please note the current benchmark Fe 62% iron ore price is approximately $US85 per tonne.

The Project is strategically located near the mining towns of Wabush and Labrador City in the province of Newfoundland & Labrador, and Fermont just over the provincial border in Quebec. The area is home to Rio Tinto IOC’s Carol Lake Mine, Champion Iron Ore’s Bloom Lake Mine, Arcelor Mittal’s Mont-Wright Mine, Tacora Resources’ Scully Mine and Alderon’s shovel-ready Kami Deposit.

The region is very well served with a paved highway, access to abundant low-cost hydro electricity, a common carrier railway with a currently under-utilized 80 million tonnes capacity allowing iron ore products to be delivered to the deep-water Port of Sept Isles, Quebec providing year-round access to global markets. The communities and their skilled workforces enjoy a great lifestyle with modern amenities including schools, medical facilities, recreation centres, shopping centres, hotels, restaurants and an airport with daily service.

Map 1 – Goethite Bay Project location map relative to other iron ore projects in the Western Labrador Trough

Details of the Transaction

Altius has granted to High Tide an exclusive option (the “Option”) to purchase the one hundred percent (100%) undivided interest in and to the Project upon: (i) High Tide incurring exploration expenditures on the Project of at least $2,000,000 by December 31, 2021; (ii) the issuance of 19.9% of the issued and outstanding common shares of High Tide immediately following cumulative equity financings of no less than $5,000,000; and (iii) High Tide becoming a publicly listed company in Canada within 24 months from the execution date.

Upon High Tide acquiring a 100% interest in the Project, Pubco shall grant to Altius a 2.75% gross sales royalty (GSR) on all iron ore produced, removed, and recovered from the Project.

Additionally, High Tide has issued 9,146,666 common shares in the capital of High Tide payable to arm’s length parties as consideration for the assumption of the rights to the Option. These consideration shares are issued at a deemed price per share of $0.10.

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of project managers together with a regional scale advanced stage gold-copper exploration portfolio in Alaska. Avidian’s Golden Zone project also hosts a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au). Additional projects include Amanita, which is adjacent to Kinross Gold’s Fort Knox gold mine in Alaska, and Jungo in Nevada. The Strickland and Black Raven properties, both located in Newfoundland, are held within High Tide Resources Corp, a private subsidiary company of Avidian.

Avidian is focused on and committed to the development of advanced-stage mineral projects throughout first world mining-friendly jurisdictions using industry best practices combined with a strong social license from local communities. Further details on the Corporation and the individual projects, including the NI 43-101 Technical report on the Golden Zone property, can be found on the Corporation’s website at www.avidiangold.com.

Technical

The technical information within this document has been reviewed and approved by Mr. Steve Roebuck, P.Geo. Mr. Roebuck is a qualified person as defined in NI 43-101.

For further information, please contact:

Bonnie Hughes, Manager Investor Relations

Mobile: +44 7538 296674

Email: moc.dlognaidiva@sehguhb

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

This News Release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.